AI Power Demand Drives Surprising Market Winners in September 2025

The investment landscape has shifted dramatically as September 2025 closes, with utilities emerging as one of the year's top-performing sectors - up 12-14% YTD - while AI infrastructure demands reshape traditional industries.

One of our trusted partners just released this presentation:

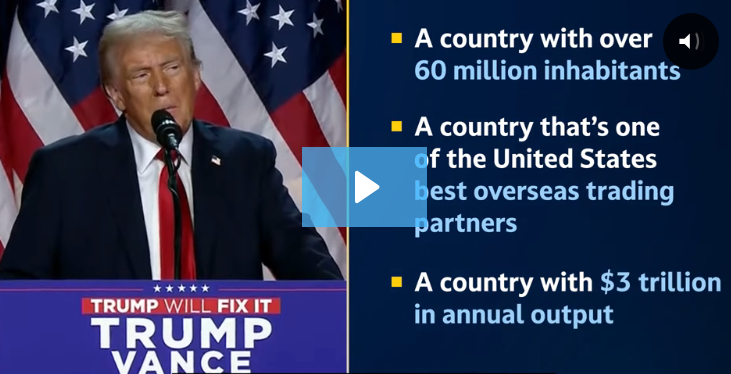

The Energy Stock Trump Once Called "A Big Mistake" to Mess With

When a U.S. ally tried to tax ONE American energy company... Trump didn't hesitate to issue a direct warning.

Now this same company is generating over $3 billion in operating income... And partnering with the hottest AI stock on Wall Street.

Out of 23,281 publicly traded stocks, this is the ONLY one that meets all the "unicorn" criteria.

DISCOVER THE ENERGY UNICORN HEREThe surprise winner? Power companies. As data centers consume unprecedented electricity to fuel AI operations, utilities have transformed from sleepy dividend stocks into growth plays. Projections suggest data center demand could represent 3-8% of total U.S. electricity consumption by 2030.

Hidden technology champions are outpacing household names. While Nvidia maintains AI chip dominance at $178/share, Celestica (CLS) has quietly delivered exceptional returns serving all major hyperscalers. Palantir (PLTR) surged 140% YTD to $177, driven by expanding government contracts and commercial AI adoption.

Critical materials create volatility and opportunity. MP Materials (MP) trades at $68-77 after wild swings, securing strategic government contracts as North America's primary rare earth producer. The lithium sector shows early stabilization after severe corrections, with battery recycling emerging as a 20% CAGR growth opportunity.

Clean energy ETFs surprise to the upside. Invesco WilderHill Clean Energy (PBW) gained 39-42% YTD, while solar ETF (TAN) rose 28-36%, driven by AI companies' renewable commitments and improving economics. Nuclear power sees renewed interest as data centers seek reliable carbon-free baseload power.

What This Could Mean for Investors

The AI revolution's infrastructure phase rewards "picks and shovels" providers more than headline AI companies. Focus on companies with actual AI-related revenue, not concepts. Consider utilities with data center exposure for defensive growth, semiconductor equipment makers for sustained capex cycles, and critical materials producers with government contracts for supply chain plays.

Diversification across these themes through ETFs reduces single-stock risk while capturing structural trends. The winners aren't always obvious - traditional infrastructure may outperform pure-play tech. Success requires distinguishing between legitimate structural shifts and speculative excess in this transformative period.

Before You Go...

Sources: Market data from Yahoo Finance, NASDAQ, MarketWatch, Seeking Alpha